02 Feb Rise in Stamp Duty for Second Homes

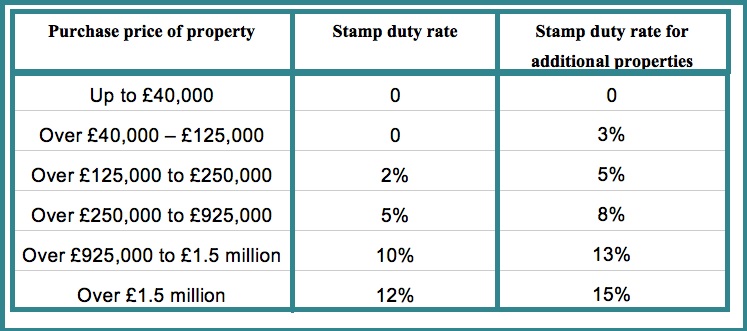

From 1 April 2016, people investing in secondary properties to either buy-to-let or use as holiday homes will have to pay an extra 3 per cent in stamp duty. These new regulations apply to properties worth over £40,000 and if you already own a property within the UK.

These new charges were announced in the Autumn Statement by George Osborne who says it will raise an extra £1 billion for the Treasury by 2021. Following this announcement the property market has experienced a surge in interest from property investors who want to buy homes before the new rates are brought in. The higher rates have not been well received by landlords who feel this will stop property investment and reduce the number of properties available to rent.

The government plans to reinvest the money raised through this scheme by helping new home owners purchase their first property. This includes the Help to Buy equity loan scheme where first home buyers can receive a five-year interest free loan worth up to 20 per cent of the property value. The government also plans to extend its investment in starter homes and local authority shared ownership properties.

If you want more information on how this rise in stamp duty may affect you, you can download the Treasury’s Autumn Spending Review, or give Kaytons a call to discuss your options.

Please contact Kaytons for a free property valuation in Manchester

No Comments